Read the Liberal MP’s complete speech at Montreal’s Canadian Bitcoin Conference, on May 17th, 2024

Source: https://www.youtube.com/live/5ZD53ytRQ-s?t=14155s

French translation here: https://lesdechaines.co/2024/10/30/discours-de-joel-lightbound-sur-bitcoin/

Bonjour à tous, bon après-midi. Ça fait un grand plaisir de vous voir en si grand nombre, à Montréal.

Good morning, everyone. It’s a great honor for me to be here, and I’m really delighted to see you all in such great numbers here in Montreal. I am a Quebecer. My name is Joel Lightbound. I was elected to the House of Commons in October 2015, representing the riding of Louis-Hébert in Quebec City. Over the years, I’ve occupied various positions such as Parliamentary Secretary to the Ministers of Health, Finance, and Public Safety. Currently, I chair the Standing Committee on Industry and Technology, a position I’ve held since 2021.

There are far more knowledgeable speakers about Bitcoin here, than myself. And also, given that I’m the only thing standing between you and your lunch, I’ll be rather brief; I won’t be here for 30 minutes.

But I do have a few thoughts I’d like to share with you.

Although my talk is titled « The Progressive Case for Bitcoin », it won’t be about that. Instead today, I’d like to share my observations on the political landscape surrounding Bitcoin in Canada. As you can imagine, as a Liberal, that speech in the House of Commons raised a few eyebrows around me.

In full disclosure, given my obligations by virtue of the code that regulates MPs, I do own Bitcoin. In full disclosure. And as I said in the speech, I am not advocating for anyone to buy it; I’ve never had, as I am not a financial adviser. But I do think that Bitcoin is definitely worth studying; because this technology is here, it’s here to stay, and I believe that it holds great potential.

In fact, I don’t know of anyone who has taken a bit of time to genuinely and seriously study Bitcoin who hasn’t been awed, either by its design, or else by the magnitude and the complexity of the problems that it leads one to think about.

Before I start, I just want to thank the organizers for organizing this conference. There’s still much education to do around Bitcoin, and this Canadian conference, while still in its infancy, it’s its second year, is already achieving a great deal on that front, so thanks for all those involved.

This is personally my first Bitcoin conference, and I know it’s already been useful in getting to meet other bitcoiners. And I’m sure – as most of you know – it’s easy to feel a bit isolated, when you wander away from Bitcoin Twitter and into the real world… So, just imagine for me, as a Liberal MP…

(laughing)

The Liberal Party is a big tent… (and) where we don’t always all agree. I’ve had my share of disagreements, over the years, on various topics: on COVID policies; on the monarchy; on medical assistance in dying, and other topics… And of course, on Bitcoin as well, I disagreed.

I’d like to take a moment to give a bit of credit though to the Prime Minister, because, under this Prime Minister, there’s been – within the Liberal Party – a lot more room for dissent and for free votes than I would think under most, if not all, other prime ministers in history… certainly in the recent history.

Now, regarding Bitcoin specifically, from my perspective, what we’ve seen on the one hand, politically here in Canada, from Pierre Poilievre buying a shawarma with Bitcoin and stating that Bitcoin a good way to opt-out of inflation, back in 2022, all the way to the other side, the Liberals attacking him for that, for the last two years; To me, all of this has a lot more to do with politics than anything else…

If we think about it, back in 2022, when Poilievre made his stunt with Bitcoin, he was not the leader of the Conservative Party; He was hoping to capture a sizable voter block, to help him secure the nomination. In that context, I think it was a smart thing to do. And it served him well.

When the Liberals saw the price of Bitcoin fall as we entered the bear market, of course they attacked him, and that messaging worked – largely – with older voters. And although I disagreed in that context, to me, it made sense politically for them to go down that path.

But notice one thing: Pierre Poilievre has not mentioned Bitcoin once – to my knowledge – ever since he won the leadership, and the attacks by the Liberals have all but stopped, since the fall, as the price has gone up. So I don’t think that any of the posturing that we’ve seen on both sides was rooted in any deeply held convictions or understanding of Bitcoin… From my perspective, it was mostly politics on both sides.

Now, I appreciate that things have calmed down. To me, that’s a good thing. There’s nothing to gain by having Bitcoin be a partisan issue in Canada. And it should not be a partisan issue in Canada. Bitcoin is for everyone. So… (applause) Thank you (…)

(Applause)

Now, I think given this… hum in French we say “Acalmie”, given this truce, the timing is really good now to get politicians to engage in a more mature discussion about Bitcoin in Canada. In fact, I can sense – from my very own colleagues – that there’s a lot more openness than there was when I first engaged with them, back in 2021 and 2022.

When you see the approval by the SEC of the spot ETFs in the US; now the Hong Kong ETFs; when you see all the financial institutions who want to offer exposure to bitcoin to their clients; when you have Larry Frink, Paul Tudor Jones, Stanley Druckenmiller or entrepreneurs like Jack Dorsey and Michael Saylor, of course, talking about Bitcoin and describe it as a “Flight to Quality” (in the case of Larry Fink); When you witness over the years the resiliency of the Bitcoin Network, which is still a 100% runtime, which still powers through, despite being banned by China, which is back above a trillion dollar market cap; it’s getting harder and harder for anyone to dismiss it as some dumb internet money. And I think there’s a growing realization that Bitcoin is a serious asset, and a serious Innovation, and that it has a future.

I find this to be very encouraging.

It’s encouraging to me, because I think it paves the way for a more nuanced discussion on how we can regulate to bring clarity to the industry, bring protection for users, secure the rights of holders, and overall to bring a climate that Fosters innovation in Canada.

And when we do have a more in-depth discussion on Bitcoin, I think the results can be interesting and, in fact, on the Industry committee which I chair, we’ve had the chance to have this discussion, we’ve studied blockchain. And some of you here, as speakers and in the audience, came to testify before the committee. And we tabled a report last year called “Blockchain technology: cryptocurrencies and Beyond”. You can find it online. And I understand that it’s broader than just Bitcoin; and “Bitcoin is not crypto”. I get that 100%. It took me a long time, but I get that now.

But the study was broader than Bitcoin, yet there are still some very relevant recommendation in that report: recommendations for a fair taxation of bitcoin miners; recommendations on the establishment of federally regulated cryptocurrency custodians to meet the demand for Cold Storage Services of firms and institutions; recommendations on better access to banking and insurance services for the industry; recommendations also on the importance of having a distinct regulatory approach to stable coins, like they do in Europe, but there’s one recommendation that’s particularly dear to my heart, and I think will be to yours too, and it would be the first slide on my deck, which has only two slides:

(I don’t know if if you can put it up there but I’ll read it in the meantime)

Recommendation 2 of this report, which was adopted unanimously states that:

« The government of Canada should, in its efforts to improve consumer protection and regulatory clarity in the emerging and innovative field of digital assets, be guided by the principle that individuals’ right to self-custody should be protected, and that the ease of access to safe and reliable on and off ramps should be defended and promoted.«

To me, this means that self-custody is a good thing; freedom of choice is a good thing; and peer-to-peer is a good thing.

There’s nothing illegal about any of that, nor should there ever be.

But that is one report about 12 parliamentarians who agreed, after hours of study and hours of testimony.

There’s still a lot more that needs to be done to educate legislators, across the country, so that we can stay above the partisan fray. And, as such, I think that bitcoiners have a role to play to reach out and explain how supporting this asset is both good politics and good policy.

And it’s good politics, because about 1 in 10 Canadians owns digital assets, and about a third of Millennials, and those numbers are steadily growing year after year.

It will be a significant voter block in elections to come. And we’re starting to see these dynamics play in the US already; It will come to Canada, as well.

It’s good policy, because, with the right approach, we can bring innovators to build on top of Bitcoin in Canada and to create economic activity. We can bring more clean and renewable energy as well to come onto the grid with Bitcoin mining, thereby reducing emissions and eliminating waste by monetizing stranded energy. And at last we can also help from Canada, empower people around the world, with bitcoin’s potential to democratize finance and to foster economic inclusion.

As a progressive, this is why I felt compelled last October to recognize the ingenious invention of Satoshi Nakamoto. But there are many things that I did not get the chance to say in the House of Commons; I only had 60 seconds. But there’s one in particular which I would have liked to say that I didn’t have the chance to:

And it’s that when you first encounter Bitcoin (to me I encountered Bitcoin back in 2012).

That’s just a parenthesis :

I used to live not too far from here, on St-Joseph Street, in the Mile-End. And I lived with four of my best friends. And there’s one afternoon I get home from work (I used to work in a law firm, here downtown Montreal); and I see that there’s someone dressed in like army gear, who (quite older; maybe in his 50’s) looks like someone who would probably be living on the streets at this point. And I asked my roommate who’s this person?

He said : «okay, I was at the Starbucks on Park Avenue (…), my friend’s a coder and he was coding. And he started talking to this guy, and he found out that the person next to him at the Starbucks on Park Avenue was a guy named “Commander X”, who was the second in command of Anonymous, at the time and that he had managed to escape the United States, come to Canada, was living on Mount-Royal, and he came to our place, stayed a couple of days, and told us all about it… (and it was all legit, you can look it up online : “Commander X”). I don’t know where he is, right now.

But we asked him : “How did you manage to pay for your coffee, for your sandwiches?” And he said, back in 2012, “Oh… I’m mining Bitcoin. If you guys want, just give me a laptop (…), I can set you up; you can mine Bitcoin here, in the apartment, for the five of you.”

I’m not a computer geek. I didn’t really understand it all that much. And I didn’t really understand… the brilliance of the monetary policy behind the Bitcoin Network. And that’s what took me a while to understand. I got into it in 2021.

But that’s really an aside. That wasn’t in my speech.

But, as a progressive learning about Bitcoin then in 2021, and taking a more serious approach, I started to ask myself different questions.

I believe in social democracy.

I believe that the state has a role to play to provide a social safety net. I believe that the state has a role to play in some redistribution of wealth; to provide for opportunities regardless of the circumstances you are born into.

But for years, I focused on what kind of fiscal policies could drive desirable outcomes, like reducing poverty for kids and for seniors, and how (by) eliminating loopholes, we could then try to reduce wealth inequalities.

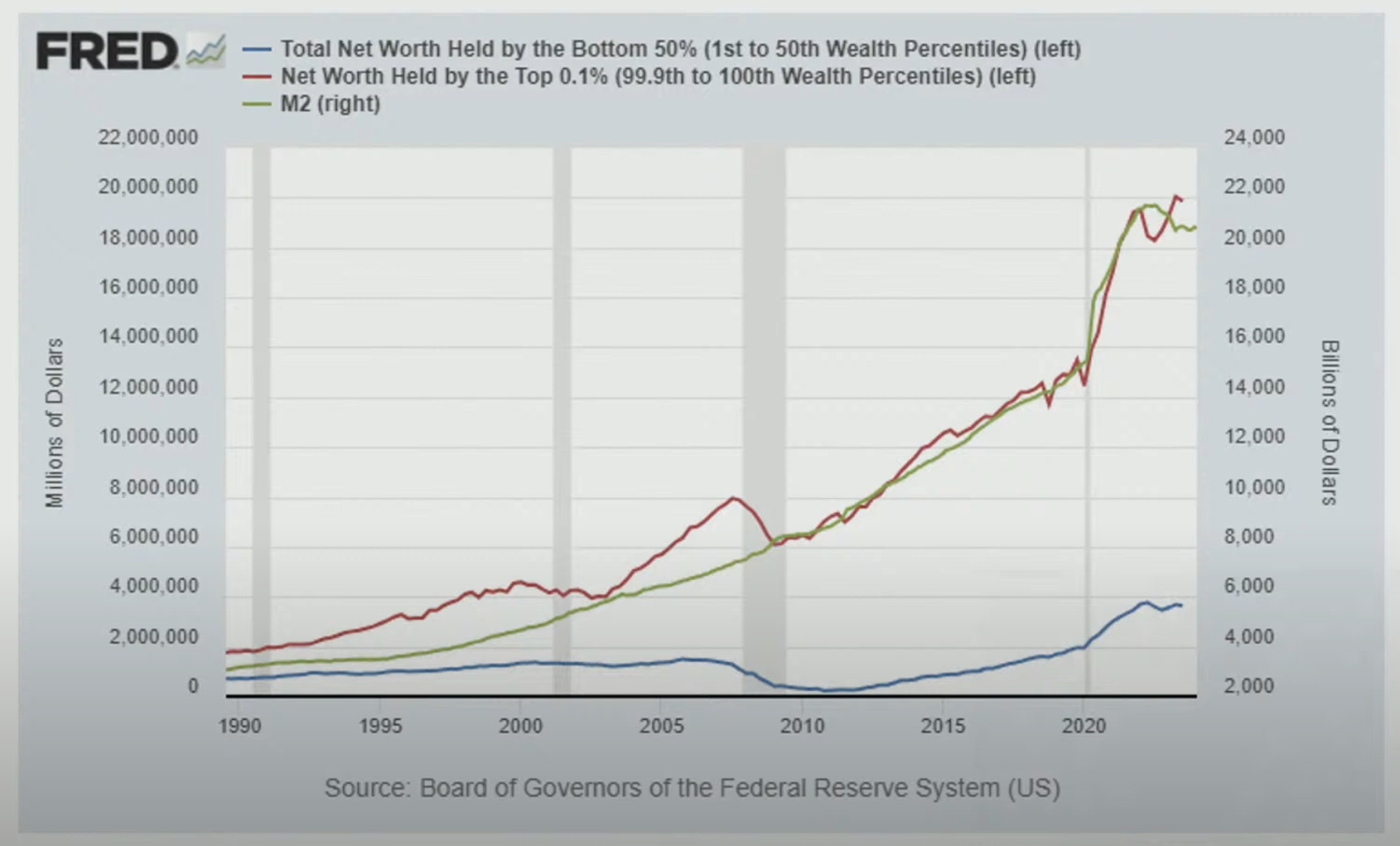

And I still believe these policies have an important role to play in our societies. However there’s something I never quite could figure out: I never could figure out why, for decades, despite rising productivity (and no matter what party governed and what policies were in place : more redistributive or less redistributive), wealth always accrued at the very top…

And that would bring me to my last slide…

Because, to understand Bitcoin, you have to understand money. This has been the most valuable thing to me.

I started asking new questions like :

- What is money?

- How is it created?

- How is it earned?

- How is it transferred?

And it got me to this chart :

And I know that any economist would tell me that a correlation is not a causation.

But this is undoubtedly a very intriguing chart.

Learning about Bitcoin got me to think about Richard Cantillon and the Cantillon effect. It got me to (the book) “Broken Money”, by Lyn Alden. And slowly, it got me to put some pieces of the puzzle together.

And it got me to realize that if you are a progressive, you definitely should care deeply about the monetary system. And although I’m far from having it all figured out. And the more I learn the more I feel ignorant (and the more I feel I need to learn); At least, I’m pretty certain that over the last few years, since 2021, I’ve started to ask myself some pretty good questions.

And I find comfort in that.

Now to conclude on a more positive note, the very small piece that I’ve managed to piece (to compose) conceptually for myself when it comes to these questions of “What is Money” and “What is Bitcoin” in relation to Money… To me, Money is infinite debt backed by trust and Bitcoin is engineered scarcity backed by energy.

And it’s simple, but it took me a while to get there. So this is to me, in no small part, what makes Bitcoin such a fascinating subject. And I’m looking forward to learn(ing) more with all of you.

Merci beaucoup pour votre attention, pour votre accueil. Je vous souhaite un bon lunch !

Laisser un commentaire